All Categories

Featured

Table of Contents

Keep in mind, however, that this doesn't state anything about adjusting for rising cost of living. On the plus side, even if you assume your choice would certainly be to spend in the stock market for those seven years, which you would certainly obtain a 10 percent annual return (which is far from particular, especially in the coming years), this $8208 a year would be more than 4 percent of the resulting nominal stock worth.

Example of a single-premium deferred annuity (with a 25-year deferral), with 4 settlement options. The monthly payout below is greatest for the "joint-life-only" option, at $1258 (164 percent higher than with the instant annuity).

The means you get the annuity will establish the solution to that inquiry. If you buy an annuity with pre-tax dollars, your costs lowers your taxable earnings for that year. According to , getting an annuity inside a Roth plan results in tax-free settlements.

How do Income Protection Annuities provide guaranteed income?

The consultant's very first step was to develop an extensive financial strategy for you, and after that describe (a) exactly how the proposed annuity matches your overall strategy, (b) what options s/he thought about, and (c) how such options would or would not have resulted in lower or higher payment for the advisor, and (d) why the annuity is the exceptional choice for you. - Secure annuities

Naturally, an advisor might attempt pressing annuities also if they're not the most effective fit for your scenario and goals. The reason could be as benign as it is the only product they offer, so they fall target to the typical, "If all you have in your toolbox is a hammer, rather quickly everything starts appearing like a nail." While the advisor in this scenario might not be dishonest, it raises the risk that an annuity is a poor selection for you.

Annuity Riders

Since annuities usually pay the agent marketing them much greater commissions than what s/he would certainly obtain for spending your money in mutual funds - Secure annuities, not to mention the no compensations s/he would certainly receive if you invest in no-load shared funds, there is a big reward for representatives to press annuities, and the extra difficult the far better ()

An underhanded expert suggests rolling that amount into brand-new "much better" funds that just occur to lug a 4 percent sales tons. Consent to this, and the consultant pockets $20,000 of your $500,000, and the funds aren't most likely to execute much better (unless you picked a lot more inadequately to start with). In the exact same instance, the consultant could steer you to buy a complex annuity with that said $500,000, one that pays him or her an 8 percent payment.

The advisor hasn't figured out how annuity repayments will be taxed. The advisor hasn't disclosed his/her compensation and/or the fees you'll be billed and/or hasn't revealed you the impact of those on your ultimate repayments, and/or the payment and/or charges are unacceptably high.

Current passion rates, and hence projected payments, are traditionally reduced. Also if an annuity is right for you, do your due diligence in contrasting annuities sold by brokers vs. no-load ones offered by the releasing business.

What is the difference between an Fixed Indexed Annuities and other retirement accounts?

The stream of month-to-month payments from Social Safety resembles those of a postponed annuity. A 2017 relative evaluation made a comprehensive comparison. The complying with are a few of the most significant factors. Given that annuities are voluntary, individuals purchasing them typically self-select as having a longer-than-average life span.

Social Security advantages are fully indexed to the CPI, while annuities either have no inflation protection or at a lot of offer an established percentage yearly rise that might or may not make up for rising cost of living completely. This type of biker, similar to anything else that increases the insurance provider's danger, needs you to pay more for the annuity, or accept lower repayments.

Where can I buy affordable Annuity Contracts?

Disclaimer: This post is intended for informational purposes just, and should not be thought about financial recommendations. You should seek advice from a monetary professional prior to making any type of significant economic choices. My profession has had numerous unforeseeable spins and turns. A MSc in theoretical physics, PhD in speculative high-energy physics, postdoc in particle detector R&D, research study setting in speculative cosmic-ray physics (including a couple of brows through to Antarctica), a quick job at a little design solutions firm sustaining NASA, adhered to by starting my very own small consulting practice supporting NASA projects and programs.

Since annuities are intended for retirement, tax obligations and charges may use. Principal Protection of Fixed Annuities.

Immediate annuities. Used by those who want trusted earnings immediately (or within one year of purchase). With it, you can tailor revenue to fit your demands and create income that lasts permanently. Deferred annuities: For those that desire to grow their cash with time, however are eager to defer accessibility to the cash up until retirement years.

Secure Annuities

Variable annuities: Gives greater potential for growth by investing your money in financial investment options you pick and the capacity to rebalance your profile based on your preferences and in a means that lines up with altering economic objectives. With repaired annuities, the company spends the funds and gives a rates of interest to the client.

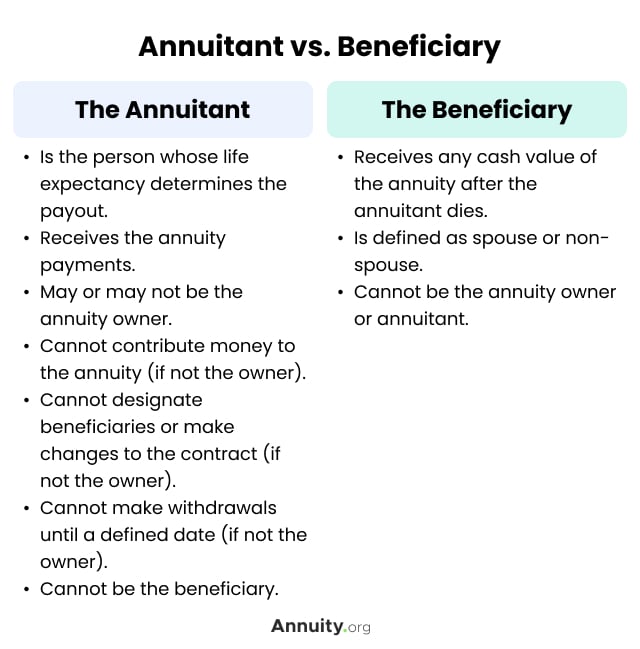

When a fatality insurance claim takes place with an annuity, it is important to have actually a named recipient in the agreement. Different choices exist for annuity fatality advantages, relying on the agreement and insurance provider. Choosing a refund or "duration particular" choice in your annuity provides a fatality benefit if you pass away early.

Immediate Annuities

Naming a recipient aside from the estate can help this process go more smoothly, and can assist make sure that the profits go to whoever the individual desired the cash to go to instead of experiencing probate. When existing, a survivor benefit is instantly included with your contract. Relying on the sort of annuity you purchase, you might be able to include improved death advantages and functions, however there might be additional expenses or fees connected with these attachments.

Table of Contents

Latest Posts

Understanding Variable Annuity Vs Fixed Indexed Annuity Everything You Need to Know About Fixed Annuity Or Variable Annuity What Is the Best Retirement Option? Advantages and Disadvantages of Differen

Breaking Down Your Investment Choices Everything You Need to Know About Indexed Annuity Vs Fixed Annuity Defining the Right Financial Strategy Features of Smart Investment Choices Why Fixed Interest A

Analyzing Strategic Retirement Planning A Closer Look at Pros And Cons Of Fixed Annuity And Variable Annuity Defining Annuity Fixed Vs Variable Features of Fixed Vs Variable Annuity Why Choosing the R

More

Latest Posts